Performance

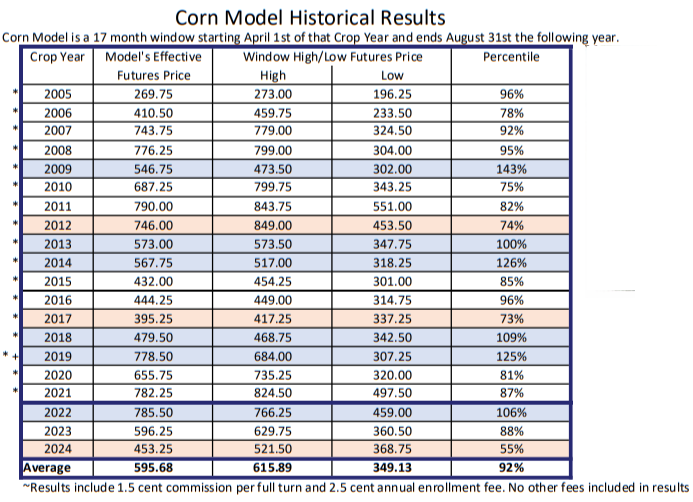

Corn Model

| Event | Date | Action | Market Price |

|---|---|---|---|

| Model Starts | 4/1/22 | ||

| Sell Signal | 4/20/22 | Sold Dec22 | 745.50 |

| Roll Dec22 | 11/1/22 | Buy Dec22 | 689.00 |

| Sold Mar23 | 694.00 | ||

| Roll Mar23 | 2/1/23 | Buy Mar23 | 679.00 |

| Sold Jul23 | 665.00 | ||

| Buy Signal | 5/31/23 | Buy Jul23 | 594.25 |

| Sell Cash | 6/15/23 | Cash Sale | 608.00 |

| Buy Sep23 | 546.00 | ||

| Sell Signal | 6/26/23 | Sold Sep23 | 590.00 |

| Model Ends | 8/31/23 | Effective Price | 788.00 |

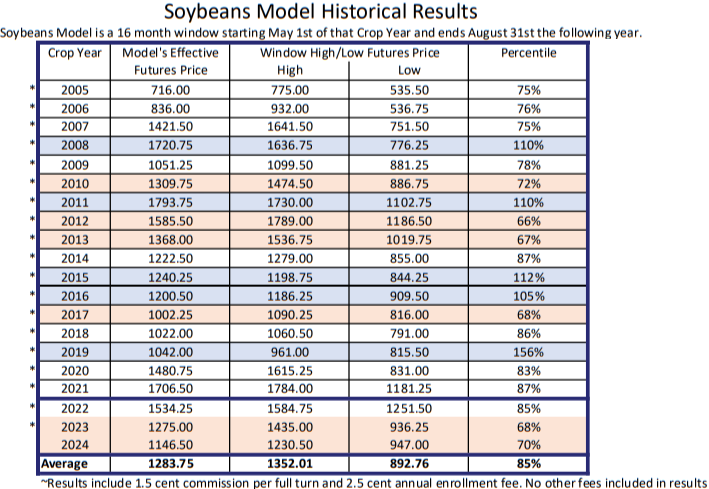

Soybeans Model

| Event | Date | Action | Market Price |

|---|---|---|---|

| Model Starts | 6/2/22 | ||

| Sell Signal | 6/2/22 | Sold Nov22 | 1514.25 |

| Roll Nov22 | 10/3/22 | Buy Nov22 | 1364.00 |

| Sold Jan23 | 1373.75 | ||

| Roll Jan23 | 12/1/22 | Buy Jan23 | 1466.00 |

| Sold Mar23 | 1472.00 | ||

| Buy Signal | 11/28/22 | Buy Mar23 | 1490.25 |

| Sell Stop | 5/18/23 | Sold Jul23 | 1331.00 |

| Buy Signal | 6/14/23 | Buy Jul23 | 1398.00 |

| Sell Cash | 6/15/23 | Sold Cash | 1389.00 |

| Buy Sep23 | 1252.75 | ||

| Sell Signal | 7/24/23 | Sold Sep23 | 1435.00 |

| Model Ends | 8/31/23 | Effective Price | 1536.75 |

*PLEASE BE ADVISED, MODEL SELLING PRICE IS BASED ON MARKET OPEN, ACTUAL FILL PRICE MAY VARY. MODEL ASSUMES A 1 CONTRACT ($5,000 INITIAL INVESTMENT) THAT WAS NOT REINVESTED. "EFFECTIVE PRICE" INCLUDES COMMISSION COST OF $75 PER FULL TERM WITH 4 FULL-TURNS BEING DEDUCTED FROM SET PRICE ALREADY. SELL AND BUY SIGNALS ALWAYS OCCUR AT THE END OF THE TRADING DAY (1:20 PM CENTRAL STANDARD TIME), THEREFORE, SELLING AND BUYING OCCUR AT THE OPEN OF THE NEXT TRADING DAY. IF TRADING OCCURS THROUGH ANY BUY/SELL STOP ORDER, A MARKET ORDER WILL BE FILLED AT THE NEXT AVAILABLE PRICE. THE MODEL PERFORMANCE SHOWN ABOVE IS HYPOTHETICAL. PLEASE BE ADVISED THAT TRADING FUTURES AND OPTIONS INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS OR PRODUCERS. THIS MATTER IS INTENDED AS A SOLICITATION. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS. SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.